Make us a beneficiary of your IRA or other “non-probate” assets

Why beneficiary designations are so powerful

Assets not included in your will are called non-probate assets. Examples are 401(k)s, IRAs, life insurance policies, and other accounts. Designating the Nepal Youth Foundation as a beneficiary can have a big impact and may avoid unwanted taxes for your heirs.

Charitable benefits

Common gifted assets for beneficiaries

- IRA

- 401(k)

- Life insurance

- Joint real estate

- Joint bank accounts

- Joint property ownership

Designate Nepal Youth Foundation as a beneficiary to one or more of your accounts.

We have partnered with FreeWill to offer this free online platform that will walk you through the process of setting up your beneficiaries. These gifts have a big impact and can often prevent unwanted taxation.

Planned giving helps fuel NYF’s mission

Since 1990, NYF’s work has helped Nepal’s children make tremendous headway as their country tackles daunting social challenges. We’ve helped transform the lives of over 60,000 kids so far, and we’re eager to continue. A gift in your will creates a foundation for the future. Our work today is important, but it is equally, if not more important, to ensure NYF can continue well into the future.

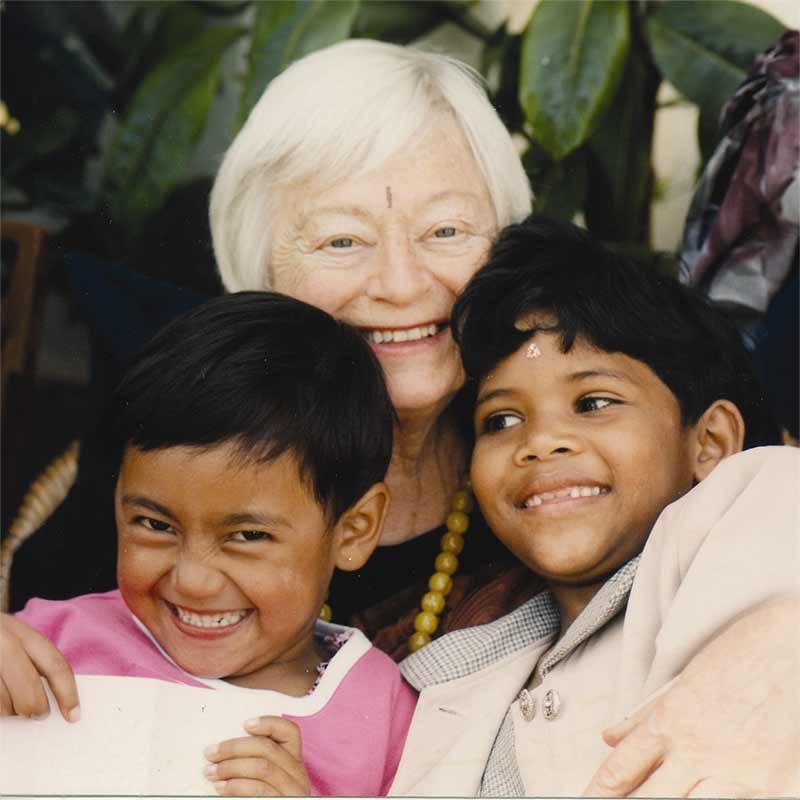

Never in my wildest dreams could I have imagined our impact would be this great. Nor, to be honest, could I have imagined the sense of responsibility I now feel to ensure that this work lives on – not just through my lifetime, but for generations to come.

If you know me at all, you know that I truly believe I am the luckiest old woman alive. My recipe for happiness is simple: Have a purpose. Pursue it with passion. Commit to it with all you’ve got. I hope you’ll join me.

Olga Murray (1925-2024)

NYF Founder & Original Legacy Circle Member

Frequently Asked Questions

A non-probate asset is an account or other asset that won’t be governed by the decisions you make in a will. Instead, these accounts commonly have an assigned beneficiary that you choose. Types of non-probate assets include many retirement accounts, life insurance, some bank accounts and some assets (like a house or vehicle) that you jointly own with another person.

The most commonly gifted non-probate asset is an IRA or 401(k). This is because these accounts are always taxed (even for people below the estate tax threshold). Giving these accounts to charity keeps your heirs from having to pay unexpected taxes.

Yes! Even if you have a will in place you still need to designate beneficiaries for your non-probate assets.

Yes! Gifts of any size are deeply appreciated. Many people choose to leave a percentage of their estate, which scales up or down with your estate size.

No. You can usually make these easily and at no cost to you.

Yes. You are always free to revise or update your estate plans.

We’re here to help you meet your goals!

Our team would be happy to speak with you in confidence about your giving goals, with no obligation.

Already included us in your estate plan? Let us know

More ways to make an impact

Gifts in a will or trust

Donations in your will or trust are (by far) the most popular type of planned gift. Learn more, or get help starting your will (for free!).

Popular tax-smart gifts

Many people are increasingly choosing to give non-cash assets, so they can have a bigger impact at less cost to them.